Managing payroll is a critical task for any business. However, it can be time-consuming, especially when you’re handling numerous employees and complex pay structures. Luckily, there’s a solution that can help streamline the process: free paycheck maker. These tools allow employers to create accurate and professional paychecks without the hassle of complex payroll systems or expensive software. In this guide, we’ll explore everything you need to know about free paycheck makers, their benefits, and how they can help employers manage payroll efficiently.

Table of Contents

ToggleWhat is a Paycheck Maker?

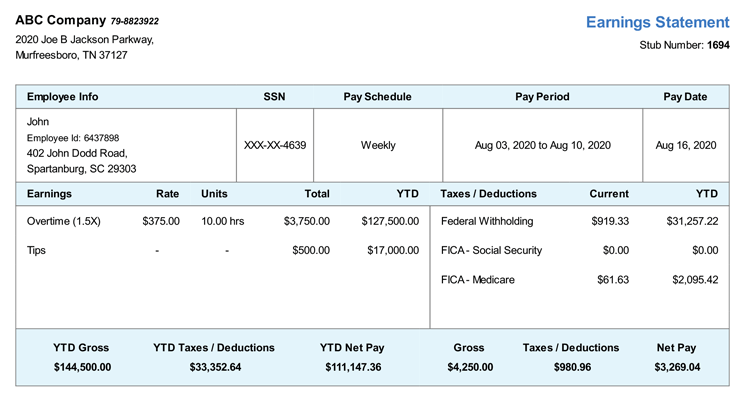

A paycheck maker is an online tool or software designed to help employers generate paychecks for their employees. These tools automatically calculate pay based on the employee’s hours worked, salary, deductions, and taxes, and then generate a pay stub that reflects this information. The pay stub typically includes:

- Employee Information: Name, address, and employee ID.

- Earnings: Hourly wage or salary, hours worked, overtime, and bonuses.

- Deductions: Taxes, insurance, and other withholdings.

- Net Pay: The amount the employee takes home after deductions.

For many employers, using a paycheck maker can be a time-saver compared to manual calculations or complex payroll software. And when the tool is free, it becomes even more attractive, especially for small businesses and startups.

Why Use a Free Paycheck Maker?

For small and medium-sized businesses, managing payroll without breaking the bank is essential. Here are some reasons why a free paycheck maker is a great option:

1. Cost-Effective Solution

Traditional payroll services can be expensive, especially for small businesses. Hiring accountants or using paid software often comes with recurring fees, adding up over time. Free paycheck makers eliminate these costs while still providing a reliable way to generate paychecks.

2. Simplicity and User-Friendliness

Free paycheck makers are designed to be easy to use, even for employers with no payroll experience. With simple, intuitive interfaces, these tools guide users through the process of creating paychecks step by step.

3. Time-Saving

Payroll can take hours to calculate manually, especially when you’re dealing with different pay rates, deductions, and tax calculations. Free paycheck makers automate these tasks, significantly reducing the time needed to generate paychecks.

4. Accuracy

Payroll mistakes can be costly, especially when it comes to tax deductions and employee benefits. Free paycheck makers use built-in formulas to calculate taxes, deductions, and other financial data accurately, helping employers avoid errors.

5. Compliance

Ensuring payroll compliance with federal, state, and local tax laws can be complex. Free paycheck makers often update their tax tables to reflect the latest changes in regulations, making it easier for employers to stay compliant.

Key Features of Free Paycheck Makers

Not all paycheck makers are created equal. Some tools offer basic functionality, while others come with additional features to enhance your payroll process. When choosing a free paycheck maker, consider the following key features:

1. Customizable Pay Stubs

A good paycheck maker should allow you to customize pay stubs with your company’s name, logo, and other relevant information. This adds a professional touch and ensures the pay stub meets your business’s needs.

2. Support for Different Pay Periods

Whether you pay employees weekly, bi-weekly, or monthly, the paycheck maker should support different pay periods. This flexibility allows you to create paychecks based on your specific payroll cycle.

3. Tax Calculations

One of the most important features of a paycheck maker is its ability to automatically calculate federal, state, and local taxes. The tool should also account for other deductions, such as Social Security, Medicare, and retirement contributions.

4. Overtime and Bonuses

Many businesses have employees who work overtime or receive bonuses. A good paycheck maker should calculate overtime pay based on the appropriate rate and include any bonuses or commissions in the paycheck.

5. Employee Details

The tool should let you enter employee information, such as hourly rate or salary, tax withholding, and deductions. It should also allow for multiple employees, especially if you have a large team.

6. Downloadable and Printable Pay Stubs

Once the paycheck is created, the paycheck maker should allow you to download and print pay stubs. This is useful for record-keeping and providing employees with physical pay stubs if necessary.

7. Security and Privacy

Employee payroll information is sensitive and confidential. A good paycheck maker should use secure connections (SSL encryption) and ensure that all personal data is kept private.

Popular Free Paycheck Makers for Employers

If you’re looking for a free paycheck maker, there are several options to choose from. Below are some of the most popular free tools available:

1. Paycheck Stub Online

Paycheck Stub Online is a free tool that allows employers to generate pay stubs for employees. It provides basic functionality, such as entering employee information, earnings, deductions, and tax calculations. This tool is ideal for small businesses with straightforward payroll needs.

2. Wave Payroll

Wave is a well-known name in the financial software industry. Its free paycheck maker offers simple payroll processing with features like automatic tax calculations, direct deposit, and downloadable pay stubs. However, Wave’s free version is limited to only the basic features, and some additional features require a paid subscription.

3. QuickBooks Payroll

QuickBooks offers a free paycheck maker that can help you generate pay stubs for your employees. It includes support for tax calculations, deductions, and overtime pay. QuickBooks also allows employers to track hours worked and manage different pay periods. However, its full payroll service is a paid product.

4. ZarMoney

ZarMoney offers a free paycheck maker with features like customizable pay stubs, tax calculations, and downloadable pay stubs. It also has a mobile app, which makes it convenient for employers to generate paychecks on the go.

5. PayStubCreator

PayStubCreator is another free tool that lets employers create pay stubs quickly and easily. It offers support for federal and state tax calculations, deductions, and customizable pay stubs. PayStubCreator is especially popular for small businesses that need a simple and quick solution.

How to Use a Free Paycheck Maker

Using a free paycheck maker is relatively simple. Follow these basic steps to generate paychecks for your employees:

1. Enter Employee Information

Start by entering the necessary details about your employee. This may include their name, address, employee ID, and pay rate (hourly or salary).

2. Add Earnings

Next, input the employee’s earnings. This may include regular wages, overtime, commissions, or bonuses. Some paycheck makers may require you to input the number of hours worked, while others will automatically calculate this based on the employee’s salary.

3. Input Deductions

The paycheck maker will need to calculate deductions, such as federal and state taxes, Social Security, and Medicare. You may also need to input deductions for benefits, retirement contributions, or garnishments.

4. Review and Finalize

Once you’ve entered all the necessary information, review the pay stub for accuracy. Make sure the tax calculations and deductions are correct before proceeding.

5. Generate the Pay Stub

After reviewing the pay stub, you can generate it. The tool will typically give you the option to download or print the pay stub for record-keeping and distribution to the employee.

Tips for Employers Using Free Paycheck Makers

While free paycheck makers are convenient and cost-effective, there are a few things employers should keep in mind:

- Stay Updated: Tax rates and regulations change frequently. Make sure the paycheck maker you use is regularly updated to reflect the latest changes in tax laws.

- Double-Check Calculations: While free paycheck makers are designed to be accurate, it’s always a good idea to double-check the pay stubs before distributing them to employees.

- Backup Payroll Records: Keep backups of all pay stubs and payroll records. This will help if you ever need to reference or provide proof of payment to employees or tax authorities.

Conclusion

A free paycheck maker is a valuable tool for employers, especially small businesses and startups, looking to simplify their payroll process without the high costs associated with traditional payroll software. These tools offer a range of benefits, from saving time and money to ensuring accuracy and compliance with tax laws. By choosing the right paycheck maker and using it effectively, employers can streamline payroll and focus on growing their business.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons