When it comes to running a small business or managing payroll, one of the key decisions you’ll face is whether to use a paystub generator or stick with manual payroll. Both methods have their advantages, but understanding which one is right for your business can make a big difference in terms of time, accuracy, and overall efficiency.

In this article, we’ll dive into the pros and cons of both payroll methods, explore how they work, and help you decide which is best for your company. Whether you’re a small business owner or a decision-maker tasked with improving your company’s payroll system, this guide will provide you with everything you need to know.

What Is a Paystub Generator?

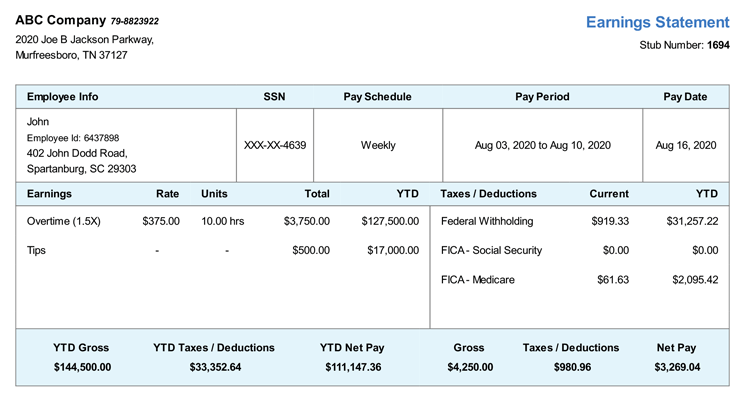

A paystub generator is an online tool that automatically creates pay stubs for employees based on the payroll data you input. These generators typically allow you to fill in necessary information, such as:

- Employee details: Name, address, and job title

- Pay information: Hours worked, salary, hourly rate, and overtime

- Deductions: Taxes, health insurance, retirement contributions, and more

Once all the required data is entered, the paystub generator generates a pay stub that you can print or email to your employees. Many paystub generators also offer additional features, such as:

- Tax calculations: Automatically computes federal, state, and local taxes based on current tax rates.

- Compliance updates: Regularly updated to meet legal requirements and tax regulations.

- Multiple formats: You can download or send pay stubs in various formats, such as PDF or Word documents.

What Is Manual Payroll?

Manual payroll involves calculating and creating pay stubs by hand. Typically, this method requires more time and effort from the business owner or HR staff. Here’s what you’ll typically do in a manual payroll process:

- Track employee hours: Use timesheets or spreadsheets to record the hours worked by each employee.

- Calculate wages: Manually compute gross wages by multiplying the hourly rate by the number of hours worked or applying salary rates for employees on fixed pay.

- Apply deductions: Deduct federal and state taxes, Social Security, Medicare, and any other benefits like health insurance or retirement contributions.

- Create pay stubs: Manually prepare pay stubs, either on paper or using software like Microsoft Excel.

- Distribute pay: Write checks or make direct deposits to employees, and send out the pay stubs.

While this approach can work for very small businesses, it requires careful attention to detail and can be very time-consuming.

Pros and Cons of Paystub Generators

Now that we know what a paystub generator is and how manual payroll works, let’s explore the benefits and drawbacks of using a paystub generator for your business.

Pros of Using a Paystub Generator

- Saves Time: A paystub generator is a major time-saver. Once you enter your employee’s data, the generator will automatically calculate everything for you. It’s far quicker than calculating payroll manually, especially as your business grows.

- Accuracy: Since paystub generators use up-to-date tax rates and deduction structures, the calculations are far more accurate than when done manually. This minimizes the risk of errors that could lead to overpaying or underpaying your employees.

- Convenience: With just a few clicks, you can generate pay stubs for all your employees, whether you’re paying weekly, bi-weekly, or monthly. It’s also easy to email or print pay stubs directly from the system.

- Compliance: Many paystub generators are designed to help your business stay compliant with federal, state, and local payroll laws. They automatically update with tax changes, reducing the risk of compliance issues that could result in penalties.

- Better Recordkeeping: Paystub generators store all your payroll records in an organized and easily accessible digital format. You won’t need to worry about losing paper records or struggling to find past pay stubs for an audit.

- Scalability: As your business grows and you hire more employees, a paystub generator can handle the increased workload without requiring a major time investment.

Cons of Using a Paystub Generator

- Cost: While many paystub generators are affordable, they do come with a cost. You’ll need to subscribe to a service, which could be an additional expense for your business, especially if you’re just starting out.

- Learning Curve: While most paystub generators are intuitive, there might still be a learning curve, especially for business owners who aren’t familiar with online payroll tools.

- Limited Customization: Some paystub generators may not offer full customization options for the layout and appearance of pay stubs. If your company has specific formatting needs, you may find these tools limiting.

Pros and Cons of Manual Payroll

Manual payroll has been around for a long time and still works for many small businesses. However, it does come with some important benefits and challenges.

Pros of Manual Payroll

- Low Cost: If you have a very small number of employees and limited resources, manual payroll may seem like an affordable option. You won’t have to pay for any software or subscription services.

- Full Control: You have complete control over the payroll process, from the hours worked to the deductions. This could be beneficial for businesses that want to keep payroll closely aligned with their specific needs.

- Personal Touch: Manual payroll can feel more personal, especially in small businesses where you know each of your employees personally. You can address payroll issues directly and quickly without the need for third-party tools.

Cons of Manual Payroll

- Time-Consuming: Calculating pay, applying deductions, and creating pay stubs manually is an incredibly time-consuming process. This can be especially challenging as your business grows and you hire more employees.

- Higher Risk of Error: Manual calculations are more prone to errors. You may miscalculate tax deductions, pay rates, or hours worked, which can lead to costly mistakes and employee dissatisfaction.

- Lack of Compliance: Staying compliant with changing tax laws and employment regulations is a huge challenge for businesses using manual payroll. Missing updates or incorrectly applying deductions could result in penalties or legal issues.

- Storage and Organization: Keeping track of payroll records manually can quickly become overwhelming. You’ll need to store physical copies of pay stubs or keep digital files organized, which can lead to confusion or lost documents.

- Difficulty Scaling: As your business grows, manual payroll becomes less practical. You may find it harder to manage payroll efficiently for a larger team, leading to delays or mistakes in employee compensation.

Which One Is Right for Your Business?

The decision between using a Free paystub generator and manual payroll largely depends on your business’s size, growth potential, and available resources.

- For Small Businesses with Few Employees: If you’re just starting and have a small team, manual payroll might seem like an affordable option. However, keep in mind the time and energy it requires. As your business grows, you may soon find that switching to a paystub generator will save you a significant amount of time and effort.

- For Growing Businesses: If your business is expanding or you have a large team, a paystub generator is a much better option. It simplifies the payroll process, reduces errors, and helps you maintain compliance with tax laws. Plus, it frees up your time so you can focus on other important aspects of your business.

- For Businesses Focused on Scalability: If you plan to scale your business quickly, a paystub generator is the way to go. It allows you to easily manage a growing workforce and stay compliant without adding significant overhead.

Conclusion

Ultimately, choosing between a paystub generator and manual payroll depends on your business’s unique needs. While manual payroll may work for very small businesses with just a handful of employees, a paystub generator offers significant time savings, accuracy, and compliance features that will benefit your business as it grows.

In the long run, investing in a paystub generator will streamline your payroll process, help you avoid costly mistakes, and ensure that your employees are paid accurately and on time. So, whether you’re a small business owner just starting or a decision-maker looking to scale, consider switching to a paystub generator to take your payroll to the next level.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season