Managing employee paychecks is a critical part of running any small business. Whether you’re a startup, a family-owned shop, or a growing company, ensuring that your employees are paid accurately and on time is essential for maintaining trust and boosting productivity. Yet, managing paychecks can sometimes feel overwhelming, especially if you’re juggling multiple responsibilities. But don’t worry—there are simple, efficient tools and strategies that can help streamline this process.

One of the most effective solutions is using a paycheck generator. In this blog, we will explore how small business owners can use paycheck generators to manage employee paychecks effortlessly, stay compliant, and improve overall payroll efficiency.

Table of Contents

Toggle1. Why Payroll Management Is Crucial for Small Businesses

As a small business owner, you wear many hats. From handling customer service to marketing and operations, managing employee payroll might not always be at the top of your to-do list. However, payroll is one of the most important aspects of running a business. Getting it wrong can lead to dissatisfaction, legal problems, and even fines. Here’s why payroll management is critical:

- Employee Satisfaction: Employees expect to be paid correctly and on time. Payroll mistakes can lead to frustration, which may affect employee morale and retention.

- Legal Compliance: There are federal, state, and local regulations that govern employee pay. Not following these can result in penalties and legal issues.

- Financial Health: Managing payroll correctly ensures that you can track labour costs, which is crucial for your business’s financial planning and sustainability.

In short, payroll management is essential for keeping your business running smoothly and ensuring your employees are happy and productive.

2. The Traditional Payroll Process vs. Automated Payroll Solutions

Traditionally, small business owners handled payroll manually. This could involve calculating hours worked, applying tax rates, deducting benefits, and creating paychecks or pay stubs by hand. While it’s possible to do payroll this way, it’s time-consuming and prone to errors.

With advances in technology, small businesses now have access to automated payroll solutions, such as a free paycheck generator, that simplify the process and reduce errors. Here’s a comparison of traditional payroll versus automated solutions:

Traditional Payroll Process:

- Manual Calculation: You have to calculate employee wages, tax deductions, benefits, and withholdings manually.

- Time-Consuming: This process can take several hours, especially during tax season or when handling overtime and bonuses.

- High Risk of Error: Manual calculations can lead to mistakes, which might result in overpaying, underpaying, or incorrect tax filings.

Automated Payroll Solutions:

- Quick and Accurate: Payroll software or paycheck generators automatically calculate wages, tax deductions, and other withholdings based on the hours worked and the employee’s information.

- Efficient: Once set up, a paycheck generator can process payroll within minutes, saving you time and effort.

- Tax Compliance: Payroll tools ensure that the right taxes are withheld and the correct forms are filed with the IRS, helping you avoid penalties for non-compliance.

The key takeaway here is that automated payroll systems, including paycheck generators, can save you time, reduce errors, and ensure that you remain compliant with tax laws.

3. What is a Paycheck Generator?

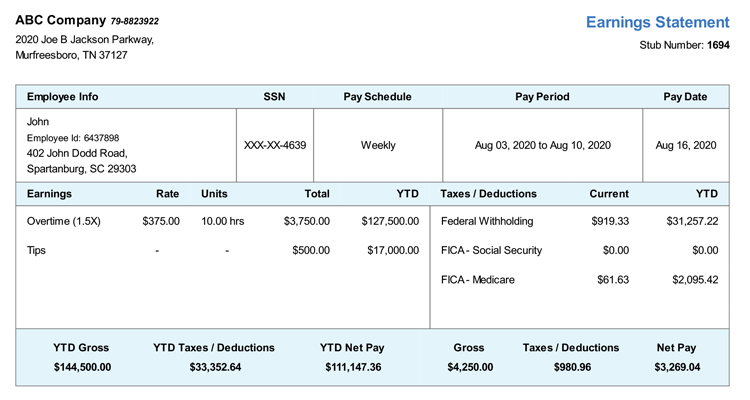

A paycheck generator is an online tool or software that helps small businesses create paychecks or pay stubs for their employees. These generators work by using the information you input (like hourly rate, hours worked, and tax information) to calculate net pay and generate a professional pay stub.

Here are some features and benefits of using a paycheck generator:

- Easy to Use: Most paycheck generators are user-friendly and require minimal input. You just need to enter basic information like employee details, hours worked, and pay rate.

- Instant Pay Stub Creation: Once you input the required information, the paycheck generator instantly generates a pay stub, which you can print or send electronically to your employees.

- Tax Calculations: A paycheck generator automatically calculates federal, state, and local taxes based on the employee’s location, ensuring that the correct amount is withheld.

- Customizable: Many paycheck generators allow you to customize the pay stubs, including adding your company logo, employee ID, and any additional deductions like health insurance or retirement contributions.

- Cost-Effective: Compared to hiring a payroll service, paycheck generators are often affordable or even free, making them a great option for small businesses with limited budgets.

By using a paycheck generator, you can eliminate manual calculations, reduce the risk of errors, and streamline the entire payroll process.

4. How to Use a Paycheck Generator for Your Small Business

Implementing a paycheck generator in your small business is simple, but it requires a few key steps to ensure everything runs smoothly:

Step 1: Choose the Right Paycheck Generator

There are many paycheck generators available online, and some are free, while others come with additional features at a cost. When choosing one, consider the following:

- Ease of Use: The generator should have a user-friendly interface that doesn’t require technical skills.

- Features: Look for a generator that can handle the specific needs of your business, such as tax calculations, benefits deductions, and multiple pay frequencies.

- Security: Ensure the software uses encryption to protect sensitive employee information, such as Social Security numbers and bank account details.

- Customer Support: A reliable customer support team can be invaluable in case you run into issues.

Step 2: Set Up Your Business Profile

Once you’ve chosen your paycheck generator, you’ll need to input your company details, such as your business name, address, and tax ID number. This information will be included on every pay stub you generate.

Step 3: Enter Employee Information

For each employee, you’ll need to enter specific information, including:

- Name and Address

- Social Security Number (or Employee ID)

- Hourly Wage or Salary

- Tax Filing Status

- Deductions: Any health insurance, retirement plan contributions, or other deductions.

- Hours Worked (if applicable): If your employees are hourly, input the number of hours worked in the pay period.

Step 4: Generate Pay Stubs

After entering the necessary details, the paycheck generator will calculate each employee’s gross pay, tax deductions, and net pay. The pay stub will also include other details like overtime pay, bonuses, and vacation hours if applicable. You can then download, print, or email the pay stubs to your employees.

Step 5: Stay on Top of Payroll Deadlines

Even though paycheck generators make the process much faster, it’s still important to stay organized and adhere to payroll deadlines. Whether you pay employees weekly, bi-weekly, or monthly, ensure that you generate pay stubs in advance and distribute them on time. This will help maintain employee satisfaction and avoid late payment penalties.

5. Benefits of Using a Paycheck Generator for Small Businesses

- Time Savings: The time you spend managing payroll is dramatically reduced, allowing you to focus on other important tasks in your business.

- Accuracy: Automated calculations reduce the risk of errors that can occur with manual payroll.

- Cost-Effective: Most paycheck generators are affordable, making them a great option for businesses that want to streamline payroll without hiring an external payroll service.

- Legal Compliance: A paycheck generator ensures that the correct tax withholdings are applied, which helps you stay compliant with IRS and state regulations.

- Improved Employee Trust: By providing clear, accurate pay stubs on time, you build trust with your employees, which can contribute to a more positive workplace culture.

6. Additional Tips for Efficient Payroll Management

- Track Employee Hours Accurately: Use time-tracking tools or apps to ensure accurate reporting of hours worked. This will make payroll processing more efficient and ensure employees are paid fairly.

- Stay Up-to-Date on Tax Laws: Tax laws can change frequently, so it’s important to stay informed to avoid issues. A paycheck generator typically includes updated tax tables, but it’s still good practice to monitor changes.

- Consider Payroll Software: If your business is growing, you might find that payroll software with additional features like direct deposit, benefits management, and reporting capabilities will be beneficial.

- Outsource When Necessary: If payroll becomes too complex or time-consuming, consider outsourcing to a payroll service provider, which can help manage everything from taxes to year-end forms.

7. Conclusion

Managing employee paychecks doesn’t have to be a daunting task for small business owners. With tools like a free paycheck generator, you can streamline payroll, ensure accuracy, and stay compliant with tax regulations—all while saving time and reducing stress. By following the steps outlined in this guide and implementing an efficient payroll system, you’ll be well on your way to managing your business’s paychecks effortlessly, keeping both your employees and your finances in great shape.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?