In today’s fast-paced, technology-driven world, businesses are constantly looking for ways to streamline operations and reduce overhead. One area where technology has made a significant impact is payroll management. For many businesses, the process of issuing paper check stubs has been replaced by digital check stubs, offering a more efficient, accurate, and environmentally friendly solution.

If you’re a business owner, HR manager, or employee, understanding how digital check stubs can simplify payroll management is crucial. In this blog, we’ll explore how digital check stubs work, the benefits they offer, and how they make payroll processing smoother for everyone involved.

Table of Contents

ToggleWhat Are Check Stubs?

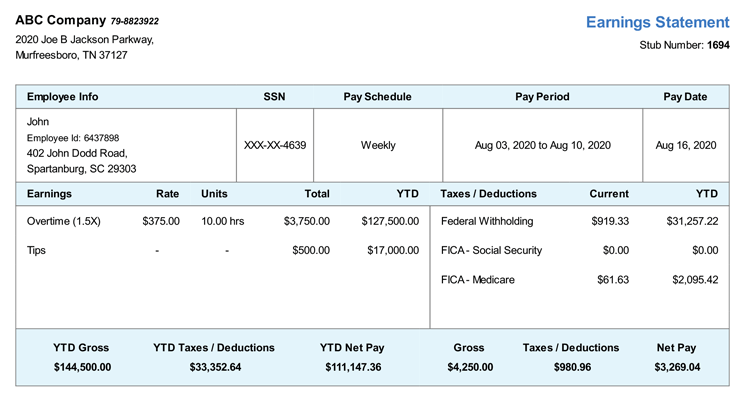

Before we dive into the digital world, let’s briefly define check stubs. A check stub is a portion of a paycheck that itemizes the wages earned, taxes deducted, and other financial details related to the employee’s pay. It serves as proof of income and provides transparency for both employers and employees.

Typically, check stubs accompany paper checks and are printed out by businesses to keep track of payroll. However, in the digital age, companies are now moving away from paper and offering digital check stubs to employees, giving everyone involved easier access and more control over their payroll information.

What Are Digital Check Stubs?

Digital check stubs are simply electronic versions of traditional paper check stubs. These digital documents are created using payroll software or online platforms, where the paycheck information is automatically calculated and formatted into an electronic stub. Employees receive their check stubs through email or via a secure online portal, making it easy to access and store the information.

Instead of having to deal with paper records, digital check stubs allow businesses and employees to handle payroll information quickly and securely. These digital records can be viewed on smartphones, tablets, or computers, ensuring that employees can access their pay details from anywhere with an internet connection.

The Key Benefits of Digital Check Stubs for Payroll Management

Now that we understand what digital check stubs are, let’s take a look at the many advantages they bring to payroll management.

1. Faster Payroll Processing

One of the biggest benefits of using digital check stubs is the speed at which payroll can be processed. With traditional paper checks, payroll departments have to print, fold, and distribute checks and stubs, which takes valuable time. Digital check stubs, on the other hand, can be automatically generated and sent to employees via email or through an online system. This significantly reduces the time it takes to prepare and distribute paychecks, improving overall efficiency.

For employers, this means less time spent on administrative tasks, freeing up resources to focus on other areas of the business. Employees also benefit from faster access to their pay information, which can be crucial for financial planning and budgeting.

2. Accuracy and Reduced Human Error

Manual processes are prone to errors, and payroll is no exception. Paper check stubs are often filled out by hand or require manual data entry into payroll systems, which increases the likelihood of mistakes. Errors in calculations, such as incorrect tax deductions or overtime payments, can lead to frustration and potentially costly issues for both the employer and employee.

With digital check stubs, much of the process is automated, reducing the risk of human error. Payroll software ensures that calculations are accurate, and any changes, such as tax rates or wage adjustments, are easily updated across all pay periods. This level of automation ensures that employees receive the correct pay on time, without the need for manual intervention.

3. Cost-Effective

Maintaining paper-based payroll systems can be costly for businesses. Between printing paper checks and check stubs, postage for mailing them to employees, and the labor involved in preparing and distributing the documents, the costs can add up quickly. By switching to digital check stubs, companies can eliminate these expenses entirely.

Additionally, digital check stubs require minimal storage space, unlike paper records, which take up valuable physical space in filing cabinets. This reduces the need for expensive storage systems and makes it easier for businesses to stay organized.

4. Improved Security

Security is a significant concern when it comes to handling employee payroll information. Paper check stubs can be lost or stolen, compromising sensitive data such as social security numbers, addresses, and bank account details. Digital check stubs, however, offer improved security measures such as encryption and secure online portals.

By sending digital check stubs via email or through a protected system, businesses can ensure that only authorized individuals have access to sensitive payroll information. This helps to prevent identity theft and other fraudulent activities, giving employees peace of mind knowing their financial data is safe.

5. Environmental Impact

In an era where sustainability is a growing concern, businesses are constantly looking for ways to reduce their environmental footprint. Traditional paper check stubs require paper, ink, and other resources to print, contributing to waste and environmental damage. By using digital check stubs, businesses can significantly reduce their paper usage and overall environmental impact.

Employees also benefit from this eco-friendly approach, as they can store and access their check stubs digitally, reducing the need for physical copies and contributing to a paperless work environment.

6. Easy Access for Employees

Employees no longer have to wait for their paper check stubs to arrive in the mail or dig through piles of paperwork to find their pay stubs. Digital check stubs can be accessed anytime, anywhere, as long as employees have internet access. This level of convenience is particularly beneficial for remote workers or those on the go, as they can easily view and download their pay information from their smartphones or computers.

In addition, digital check stubs are often stored in secure online portals, making it easy for employees to access their past pay stubs whenever they need them. Whether it’s for loan applications, tax filing, or personal records, having a digital archive of pay stubs can save employees a lot of time and hassle.

7. Simplified Record Keeping

With digital check stubs, businesses and employees no longer have to worry about storing bulky paper records. Digital check stubs can be saved and organized on cloud-based systems, making it easy for both employers and employees to keep track of payroll history.

For businesses, this simplifies tax reporting and financial audits, as all pay stub data is readily accessible in one centralized location. Employees can also organize and retrieve past pay stubs with just a few clicks, eliminating the need for paper filing systems.

8. Compliance and Legal Requirements

In the United States, businesses are required by law to provide employees with accurate pay stubs that detail their earnings, taxes withheld, and deductions. Digital check stubs make it easier for businesses to comply with these regulations by automatically generating pay stubs that meet legal requirements.

Moreover, digital systems often include features that automatically update tax rates and other legal information, ensuring that the pay stubs are always in compliance with current laws. This can help businesses avoid costly fines or penalties for non-compliance.

How to Implement Digital Check Stubs in Your Business

For business owners or HR managers considering making the switch to digital check stubs, here are a few steps to get started:

- Choose a Payroll Software Solution: There are many payroll software platforms that offer digital check stub functionality. Look for one that integrates with your existing payroll system, is user-friendly, and complies with legal requirements.

- Inform Your Employees: It’s essential to inform employees about the switch to digital check stubs, including how they can access their pay stubs and how the system works. Provide training or tutorials to ensure everyone is on the same page.

- Ensure Security: Make sure your payroll software offers robust security features to protect sensitive employee information. Use encryption, secure logins, and multi-factor authentication to safeguard payroll data.

- Provide Access and Support: Give employees access to their digital check stubs through an easy-to-use online portal or mobile app. Offer customer support to assist with any questions or technical issues.

- Transition Gradually: If you’re transitioning from paper check stubs to digital, consider a gradual approach. You can start by offering digital check stubs alongside paper ones until employees become accustomed to the new system.

Conclusion

In conclusion, digital check stubs make payroll management much simpler and more efficient for businesses and employees alike. They reduce administrative burden, improve accuracy, save costs, and provide employees with easy access to their pay information. By adopting digital check stubs, businesses can enhance their payroll processes while contributing to a more sustainable and secure work environment. Whether you’re a small business owner or part of a larger organization, moving to digital check stubs is a smart decision that can benefit everyone involved.

Make the change today, and experience how much simpler and faster payroll management can be with digital check stubs.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?