Nonprofits work tirelessly to make a positive impact on their communities, whether it’s through education, health, environmental efforts, or advocacy. However, managing a nonprofit’s finances can be a daunting task, especially when funds are tight and every dollar counts. Payroll, in particular, can be a complicated and time-consuming process. Using a free paycheck calculator can simplify this process while improving financial planning and transparency for nonprofit organizations.

In this blog, we’ll explore how nonprofits can use free paycheck calculators to streamline payroll, budget more effectively, and ensure compliance with tax laws. Whether you run a small charity or a large nonprofit organization, this tool can help you save time and resources so you can focus on your mission.

Table of Contents

ToggleWhat Is a Free Paycheck Calculator?

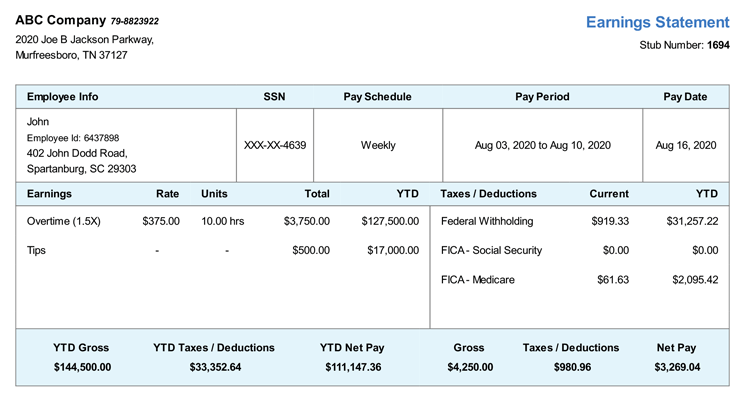

A free paycheck calculator is an online tool that helps organizations calculate employee wages accurately. By entering details such as gross salary, hours worked, and deductions (like taxes, benefits, or retirement contributions), these calculators generate net pay figures. They’re especially valuable because they provide a clear breakdown of all deductions, ensuring that employees are paid correctly and taxes are calculated properly.

For nonprofits, where budgets are often tight, these free tools can eliminate the need for costly payroll software or outsourced payroll services.

Why Payroll Accuracy Matters for Nonprofits

Payroll isn’t just about paying employees—it’s about maintaining trust, staying compliant with laws, and ensuring smooth operations. Here’s why accurate payroll is especially important for nonprofits:

- Employee Morale: Nonprofits rely on dedicated staff and volunteers. Timely and accurate pay ensures they remain motivated and satisfied.

- Compliance with Laws: Nonprofits must follow tax and labor laws to avoid fines or penalties that could strain resources.

- Transparency for Stakeholders: Donors, board members, and grant organizations expect nonprofits to maintain clear and accurate financial records. Payroll plays a significant role in meeting these expectations.

How Free Paycheck Calculators Help Nonprofits Improve Financial Planning

1. Streamlining Payroll Management

Manually calculating payroll can be time-consuming and prone to errors. A free paycheck calculator simplifies this process, allowing nonprofits to:

- Accurately calculate employee pay.

- Save time by automating complex calculations.

- Reduce the risk of human error in payroll deductions or tax withholdings.

2. Improving Budgeting and Resource Allocation

Payroll is often one of the largest expenses for nonprofits. By using a free paycheck calculator, organizations can:

- Predict total payroll costs, including taxes and benefits.

- Allocate resources more effectively, ensuring funds are available for programs and initiatives.

- Create accurate financial reports for grants and donor applications.

3. Ensuring Tax Compliance

Nonprofits face unique tax challenges, especially if they operate in multiple states or have part-time employees. A paycheck calculator helps ensure:

- Proper tax withholdings for federal, state, and local taxes.

- Compliance with Social Security and Medicare requirements.

- Accurate record-keeping in case of audits.

4. Supporting Grant Proposals and Fundraising Efforts

When applying for grants or seeking donor support, nonprofits often need to provide detailed financial projections. A paycheck calculator can generate accurate payroll data, making it easier to justify budget needs and demonstrate transparency.

Key Features to Look for in a Free Paycheck Calculator

Not all paycheck calculators are created equal. For nonprofits, it’s important to choose a tool that meets your specific needs. Look for the following features:

- Ease of Use: A simple interface that doesn’t require payroll expertise.

- Customization Options: The ability to adjust for unique payroll needs, such as stipends for volunteers or tax-exempt wages.

- Detailed Reports: Clear breakdowns of deductions, benefits, and net pay.

- Accuracy: The tool should include the latest federal and state tax rates.

- Mobile Accessibility: A cloud-based tool that works on desktops, tablets, and smartphones.

How to Use a Free Paycheck Calculator for Financial Planning

1. Calculating Employee Wages

Nonprofits often employ a mix of full-time, part-time, and seasonal workers. A paycheck calculator makes it easy to calculate wages for all types of employees, ensuring accurate payments every time.

2. Managing Volunteer Stipends

Many nonprofits provide stipends or reimbursements to volunteers. A paycheck calculator helps organizations track and distribute these payments accurately, ensuring transparency in their financial records.

3. Allocating Program Costs

Nonprofits running multiple programs can use paycheck calculators to allocate payroll expenses to specific projects. This not only simplifies budgeting but also ensures accurate reporting to donors and stakeholders.

4. Planning for Tax Obligations

Paycheck calculators break down tax withholdings, helping nonprofits set aside the correct amounts for federal and state taxes. This reduces the risk of unexpected tax bills or penalties.

5. Preparing for Growth

As nonprofits grow, so do their payroll needs. Paycheck calculators make it easier to plan for hiring new staff, offering benefits, or expanding programs without overspending.

Real-Life Scenarios: How Nonprofits Benefit from Paycheck Calculators

Scenario 1: Managing Seasonal Payroll

A nonprofit organizing a summer camp hires temporary staff during peak months. Using a free paycheck calculator, they quickly calculate wages for seasonal workers, ensuring everyone is paid on time without disrupting their regular operations.

Scenario 2: Allocating Grant Funds

A nonprofit receives a grant to run a new health initiative. The grant requires detailed payroll projections. With a paycheck calculator, the organization generates accurate data to include in their grant report, showing responsible use of funds.

Scenario 3: Tracking Part-Time Pay

A nonprofit hires part-time tutors for an after-school program. By using a paycheck calculator, they accurately calculate each tutor’s pay based on hours worked and deduct the appropriate taxes, keeping everything compliant and organized.

Advantages of a Free Tool for Nonprofits

- Cost Savings: Free paycheck calculators eliminate the need for expensive payroll software or professional services.

- Flexibility: Many tools are available online, making them accessible from anywhere.

- Scalability: These calculators can handle a growing workforce as the nonprofit expands.

- Transparency: They generate detailed reports that can be shared with stakeholders, ensuring accountability.

Challenges and How Paycheck Calculators Help Overcome Them

Challenge 1: Limited Resources

Nonprofits often operate with minimal staff and tight budgets. Paycheck calculators save time and resources, allowing the team to focus on mission-driven activities.

Challenge 2: Complex Payroll Needs

Nonprofits frequently deal with unique payroll situations, such as volunteer stipends or tax exemptions. Customizable paycheck calculators simplify these complexities.

Challenge 3: Regulatory Compliance

Staying compliant with tax laws is a constant challenge. Paycheck calculators help nonprofits stay on top of tax regulations, avoiding costly errors or penalties.

Choosing the Right Free Paycheck Calculator

Before selecting a paycheck calculator, consider:

- Reputation: Choose a tool with positive reviews and reliable performance.

- Features: Ensure it meets your nonprofit’s specific needs, such as customization for part-time or stipend payments.

- Security: Verify that the tool protects sensitive payroll data with encryption.

- Support: Look for a tool with helpful customer support or online resources.

Conclusion

Managing payroll doesn’t have to be a headache for nonprofits. With a free paycheck calculator, organizations can simplify payroll processing, improve budgeting, and ensure compliance with tax regulations—all without stretching their already limited resources.

By adopting this tool, nonprofits can focus less on administrative tasks and more on their mission to create positive change. Whether you’re managing a small team or planning for future growth, a paycheck calculator is a practical, cost-effective solution that can make a big difference.

Start exploring free paycheck calculators today and take the first step toward more efficient financial planning for your nonprofit.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal