You will receive a notification to complete enrollment at the email address you have provided. This email will prompt you to click a link redirecting you to the ORUS site and confirming your registration. If you did not receive an email notification from BIR, check your SPAM folder. You need to know the above basic entry when you post the balances later on to your General Ledger. You need to write additional information like the TIN, Purchase Invoice/Reference Receipt, and VAT Input Tax from your purchases.

- No other entry would be made until reimbursement is requested and supported by whatever documentation is needed; then, an entry like the following would be made to summarize all the petty cash transactions.

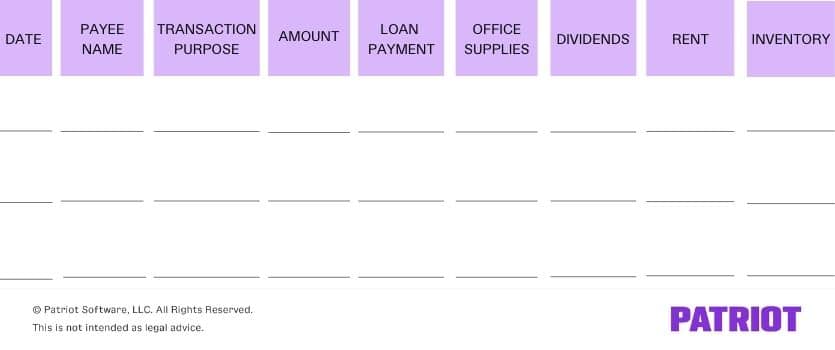

- We will receive the total Disbursement for this time and can see which categories it was broke out too.

- 19 January 2023 – Purchased a freezer from PQR and paid $5000 via check no. 123.

- If the company purchased supplies with cash regularly, such transactions might fall under the Landscaping Supplies.

- The technique allows businesses to delay payments and retain excess funds in their accounts for as long as possible, maximizing the available cash for investment or debt payments.

- Accurate record-keeping is important for financial reporting and budgeting to keep track of the cash flows.

Understanding accounts receivable

Read on to get a closer look at recording cash disbursements in your books. A cash payment journal, also known as a cash disbursement journal, is used to record all cash payments (or disbursements) made by the business. Keeping records is key to maintaining the financial health and well-being of any business or household. Using a cash book is a great way to help manage and account for cash-related transactions, including receipts and payments.

Explanation of the columns used in cash receipts journal

The cash receipts journal manages all cash inflows of a business organization. In other words, this journal is used to record all cash that comes into the business. For recording all cash outflows, another journal known as the cash disbursements journal or cash payments journal is used. At the end of each accounting period (usually monthly), the cash disbursement journal column totals are used to update the general ledger accounts.

Petty Cash: Definition

Cash disbursement payments show how much money is flowing out of a business. You can compare your company’s disbursements to the money coming into your business to determine whether you have a positive or negative cash flow. The hypothetical scenario showcases how a cash payments journal is cash disbursement journal example crucial in transparent financial reporting and strategic decision-making for TechTech Solutions. It is important to understand that if any cash is paid, even if it relates only to a part of a larger transaction, then the entire transaction is entered into the cash disbursements journal.

Controlled Disbursements

Users often use some form of accounting software to manage the triple-column cash book. Your accounting software will probably include some type of disbursement and purchase journals customizable to your business needs. A cash disbursements journal is where you record your cash (or check) paid-out transactions. Record all details for all journal entries in the cash disbursements journal, such as the payee’s name, the purpose of payment, and any additional notes or comments.

To Ensure One Vote Per Person, Please Include the Following Info

The special journal will be shorter than recording journal entries for every transaction at the end of the period (month, week, day). For this reason, you might see it being simply referenced as Purchases Discount. For any cash payment that does not involve purchases, the bookkeeper would use the Other Accounts column.

This will help you discover any errors you made in recording your payables. A reconciliation might also help you catch any errors on vendor bills. Through virtual bookkeeping, one can ensure that business owners are well prepared for their taxes. The bookkeeping service with single entry bookkeeping, double entrybookkeeping, or even accrual bookkeeping makes sure that the transactions are efficiently recorded. These revised transactions help in generating reports, which are ideal for forecasting budgets and double revenue.

We will receive the total Disbursement for this time and can see which categories it was broke out too. Our first step is to record the transactions into the Cash Payment Journal. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

In any case, there should always be an “other” column to record amounts which do not fit into any of the main categories. Some companies include discounts received column in the Cash Payment Journal. So purchase from a supplier will be recorded in the accounts payable ledger by crediting Cash and Discounts allowed accounts and debiting the Accounts payable. Creating journal entries for small business transactions should be like second nature.