Property Damage Claim: The Ultimate Guide in Order for You to Receive What is Yours.

Let’s suppose that a turbulent storm engulfs your area and the next thing you realize is either a roof that is leaking, windows that are broken, or even worse. Property damage is something that everyone faces from time to time and it is mainly at the most inopportune of times. When it does occur however, the price range for the repairs is quite high. That’s where Property damage claims come in, allowing you to seek compensation for unexpected losses.

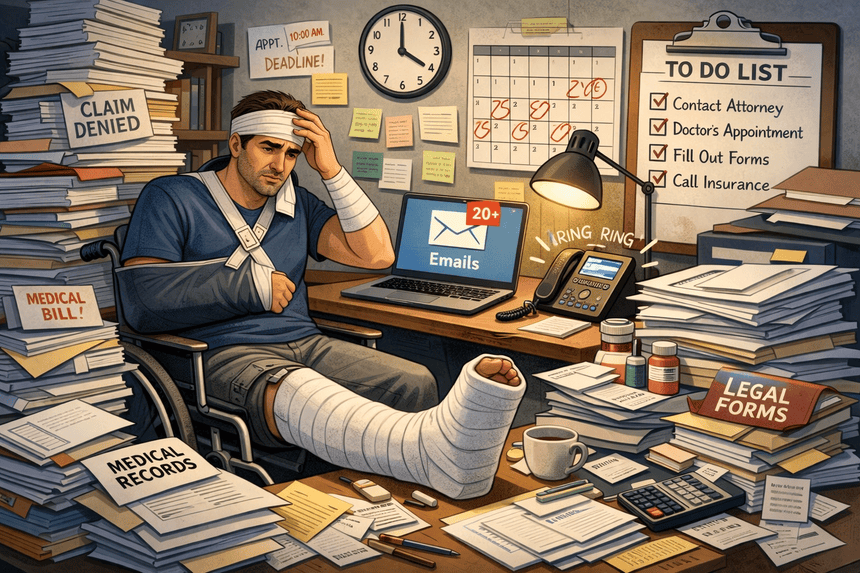

But the process of settling a claim for property damage does not come out as straight forward and fast. This is especially so when interacting with insurance companies who would use a lot of jargon and require a lot of paperwork. In this guide, we will break down the entire procedure of looking for damages and filing a claim to get the payout. And if you need extra help along the way, Legal Assist is here to ensure you aren’t left to fend for yourself.

-

What is a Property Damage Claim?

Property Damage Claims

In the simplest terms, a property damage claim is a monetary request submitted which is paid against the available policy with the insurance company for the particular property which has been damaged. This could encompass anything from damage caused by a storm flooding to theft or damages which may come from vandalizing. Filing a claim helps you to defray the expenses incurred for repair or replacement as much as possible.

-

Types of Property Damage Covered by Insurance

Property damage coverage brings such coverage as: Property damage coverage is appropriately categorized as follows:

Natural Disasters: Storms damage, flood damage, fire damage and other disaster types

Unintentional Damage: An occurrence of an event not out of the schedule such as a burst sewer pipe or even a fallen tree.

Vandalism or Theft: A form of damage that results from purposely hurting something or taking away a part of it or all of it.

-

Safeguard Your Claim: What is a Property Damage Claim Form and When is it Timely Filed?

The most critical point is how and when to file your claim. It’s generally best to file as soon as possible after the damage occurs. Otherwise, delay might not work to your advantage. The reasons being that the delay makes the insurers cast doubt on the legitimacy of your claim or more so deny it.

-

Measurement of the Degree of Damage

Start by carefully inspecting the ordinary and storm-damaged structures, especially those that require repair. Take memos on the things which have been affected and the degree of such damage. If you feel you cannot gauge the level well, it’s better to get the services of a qualified assessment.

-

Finally, Presenting Evidence to Your Claim

It can be said that documentation is the spine of any claim. So take clear images of the damage to property and record short videos explaining the contents of the damage. Prepare a comprehensive list of all affected items. And if at all possible, try to find any purchase receipts or paperwork that was associated with the property that was damaged.

-

Clarifying What is Covered by the Insurance Policy

For every type of coverage when a claim is made, their insurance policy will very well clearly indicate for each type of claim what type of damage and or type of risk is covered and what is not covered. It is important to bear these particulars in mind when proceeding to lodge a claim. For instance, if something does not seem right, you can ask Legal Assist for the clarification of the questionable details.

-

How to File a Property Damage Claim

Inform Your Insurer: Call in your loss and obtain further instructions on your claim.

Provide Supporting Evidence: Submit proper evidence such as pictures, videos, payment receipts and reports.

Fill in the Claim Form: Properly and timely have the necessary documents completed.

Post Assessment Claim: Check you have declared all the things you want and are entitled to before you make the submission.

Lodge Your Claim: Put together all that was requested and sent to the insurer and sit and wait.

-

Insurance Adjusters in an Insurers Business

Once you have lodged your claim, someone will come to your place, called an adjuster, and assess the damages. Make yourself available and give out any extra information needed. This is very important in ascertaining the extent of the damages regions for where you expect to get paid.

-

How Do You Determine the Value of Your Claim

Value of the claim will be determined by adding repairs, replacement cost, and various expenses incurred in the process of the damage. You need to be balanced because, although it may be realistic to expect reimbursement, remember not to undersell your claim. Another option is to obtain an expert evaluation should there be uncertainty as to the request towards the compensation.

-

Notable Errors That Should Not Be Made When Submitting a Claim

Avoid the following common mistakes:

Pursuing the Claim: Refusing to take action can cause denial of the claim in the long run.

Inadequate damage details: Be it, however small the damage utilizes, all the damages should be declared.

Disregarding the stipulations of your Policy’s Limits: Be aware of the coverage on the policy and what amount is the maximum compensation.

-

In What Ways Legal Assist Will Assist with Your Property Damage Claim

The process of filing a claim can indeed be overwhelming especially with the way insurance providers tend to complicate matters. Legal Assist will change that. We assist you in comprehending your rights in the event of untoward instances, assembling appropriate papers, and dealing with the insurance company in order to achieve utmost coverage. At Legal Assist, you are more than a statistic – another claim; you are a customer.

-

What Should You Do in Case Your Claim is Not Accepted

Should for any reason the claim be unjustly denied, be persistent. The thing is, there are always a lot of reasons why a claim would be rejected – however, they can almost always be appealed. Check the reasons in the letter of denial for completeness so you understand both the reasons, and what will need to be collected for the evidence.

-

How to Manage a Request for Appeal After Property Damage Claim Was Denied

For a claim appeal, you must write a letter addressed to the insurer whereby you outline the reasons as to why the insurer must pay the claim. To challenge the denial, submit additional information, such as photographs or expert reports. This procedure is well known to Legal Assist and will ensure that chances of success in the appeal are maximized.

-

How to Ensure Efficient Claims Processing Procedures in Place to Reduce Turnaround Times

The following are some of the measures which can be employed to ensure that your claim is processed quicker: Be Organized: a very important aspect of work which is sadly neglected by many especially in the field of insurance. Stacking all the papers in a single place and providing answers to every request is a good practice.

Consistent Communication: Keep tabs on your insurer on a constant basis.

Get a Public Adjuster: Public adjusters are especially useful if the claim involves more complicated matters.

-

COMBAT PREVIOUS PROPERTY DAMAGE.

It is acknowledged that some damage will happen. However, some measures can help to prevent damage from occurring. Some of these active measures include carrying out repairs periodically, fixing alarms, and other building regulations related to their features.

Recommendations.

Moving forward, filling out a claim relating to the damage of your property should not be a worrisome affair. It is important to understand how the system works and which measures you can take to ensure that you receive a fair settlement. In case you feel that the situation is becoming too complicated, do not hesitate, Legal Assist is here to help. We will do our best to handle your case from the moment of filing it to the moment you get paid.

Frequently Asked Questions:

How long does the process of applying for property damage pay take?

The time assists and completes generally varies and therefore ranges from weeks to up to two months depending on the matter at hand.

What If I Sue for Claim and They Tactically Sue Me with an Underpayment?

In the event where you assert oneself to a payout that has been farfetched, solicit the services of Legal Assist who will walk you through ways of appealing or negotiating.

Is there a statute of limitations to consider when filing a property damage claim?

Indeed, most policies contain an element of time measuring such periods within thirty days to one year from the date which the damage takes place.

What if I don’t have sufficient evidence?

You may have problems with your claim if there is not enough evidence. You may try to get as much as possible, but almost every time Legal Assist will make your claim even more potent.

Can I manage a property damage claim on my own?

It is possible, however, with Legal Assist there is a better chance that you will be able to decipher the situation without unnecessary anxiety and increase the risk of receiving a reasonable compensation.

With these steps you and Legal Assist will be able to work on the property damage claim process and you will be compensated fairly.

READ ALSO: