Introduction

Finding the best payment gateways for your business is crucial for smooth and secure transactions. High transaction fees can significantly reduce profits, especially for startups and small businesses. In this guide, we compare the best payment gateways with the lowest transaction fees, helping you choose the most cost-effective option.

???? Key Takeaways:

✅ A payment gateway ensures secure online payments.

✅ Lower transaction fees help maximize business profits.

✅ This guide compares the best payment gateways, including Stripe, PayPal, Razorpay, Square, and Authorize.Net.

What is a Payment Gateway & Why Does It Matter?

A payment gateway is an online service that facilitates secure transactions between businesses and customers. Choosing the best payment gateway can impact:

- Transaction Speed — Faster payments improve user experience.

- Security & Fraud Protection — Reduces risks and chargebacks.

- Transaction Fees — Lower costs help increase revenue.

If you’re looking for the best payment gateways, you need to consider factors such as security, integration options, and, most importantly, transaction fees.

Comparison of the Best Payment Gateways with Lowest Transaction Fees

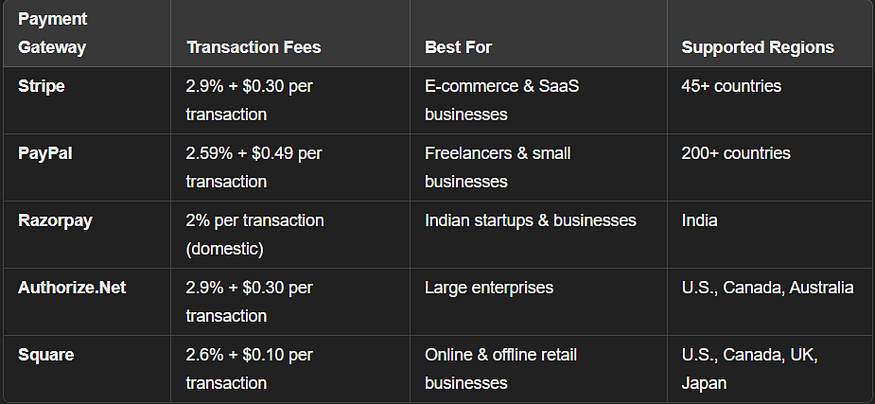

Here’s a side-by-side comparison of the best payment gateways, including transaction fees, regions, and best use cases:

Which Payment Gateway Has the Lowest Transaction Fees?

As shown in the graph, Razorpay has the lowest transaction fees at 2%, making it ideal for Indian businesses. Square and PayPal offer slightly better rates than Stripe and Authorize.Net, making them more cost-effective for certain use cases.

Top Features of the Best Payment Gateways

The best payment gateways provide more than just low fees. Here are some key features to look for:

1. Security & Fraud Protection

- PCI DSS Compliance for safe transactions.

- AI-based fraud detection to prevent chargebacks.

2. Multi-Currency & International Support

- Stripe and PayPal support over 135+ currencies.

- Razorpay is best for Indian transactions.

3. Fast Payouts & Settlement Periods

- Square and PayPal provide same-day settlements.

- Most gateways have a 2–5 business day payout cycle.

4. Ease of Integration

- Stripe and Razorpay offer developer-friendly APIs.

- PayPal and Square have easy plug-and-play integrations.

How to Choose the Best Payment Gateway for Your Business?

When selecting the best payment gateways, consider these factors:

✅ Transaction Fees — Lower fees mean better profit margins.

✅ Ease of Integration — Ensure it integrates seamlessly with your website or mobile app.

✅ Security & Compliance — Look for PCI DSS compliance and advanced fraud detection.

✅ Multi-Currency Support — If you serve global customers, opt for a payment gateway that supports international transactions.

✅ Customer Support — A 24/7 support team ensures minimal downtime and quick issue resolution.

Also Read: How to Choose the Best Payment Gateway for Recurring Billing

Hidden Fees & Extra Costs to Consider

Some payment gateways may have additional fees beyond transaction charges. Be aware of:

- Currency Conversion Fees (PayPal has 3–4%)

- Chargeback Fees (Razorpay & Stripe charge $15 per dispute)

- Annual/Setup Fees (Authorize.Net charges $25/month)

Choosing the best payment gateway means factoring in these costs for better financial planning.

Final Thoughts: Which Payment Gateway Should You Choose?

???? Choose Razorpay if you need the best payment gateway with the lowest transaction fees for Indian transactions.

???? Choose Stripe for global reach and API-driven solutions.

???? Choose PayPal for freelancers and international transactions.

???? Choose Square if you run a retail business with online and offline payments.

???? Choose Authorize.Net if you need enterprise-grade security and fraud protection.

By selecting the best payment gateway, businesses can reduce transaction fees, improve customer experience, and maximize revenue.

Stay ahead in the fintech space with expert insights and advice. For more in-depth reviews and resources, check out TheFinRate!

Frequently Asked Questions (FAQs)

1. Which payment gateway has the lowest transaction fees?

???? Razorpay offers the lowest fees at 2% per transaction for domestic payments in India. For global businesses, Square and PayPal offer competitive pricing.

2. Which payment gateway is best for international transactions?

???? Stripe and PayPal are the best payment gateways for handling multi-currency transactions in over 200+ countries.

3. Does PayPal charge additional fees for international payments?

???? Yes, PayPal charges an additional currency conversion fee on international transactions, so businesses should factor this into their pricing.

4. Can I use multiple payment gateways for my business?

???? Yes! Many businesses integrate multiple payment gateways to offer customers more payment options and reduce the risk of transaction failures.