Managing payroll can be a challenging task, especially for small business owners, freelancers, and self-employed professionals. Keeping track of hours worked, deductions, and taxes can quickly become overwhelming. However, a free payroll check maker can simplify the process, helping businesses generate accurate paychecks with ease.

Why Payroll Can Be a Headache

Payroll management involves multiple responsibilities, from calculating employee wages to ensuring compliance with tax regulations. Here are some of the biggest challenges businesses face:

- Complex Calculations: Payroll includes gross pay, deductions, benefits, and taxes, which can be time-consuming to calculate manually.

- Compliance Issues: Federal and state laws require businesses to follow strict payroll rules, and mistakes can result in penalties.

- Record-Keeping Requirements: Employers must keep payroll records for tax and legal purposes, which adds to the administrative burden.

- Employee Payment Delays: Without an efficient system, payroll processing can take longer, delaying payments and causing dissatisfaction among employees.

How a Free Payroll Check Maker Can Help

A free paycheck creator provides an easy solution for businesses to generate accurate payroll checks without the hassle. These online tools are designed to streamline the process and reduce errors. Here’s how they can benefit businesses:

1. Saves Time

A payroll check maker automates calculations, eliminating the need to manually compute wages, deductions, and taxes. This means you can generate paychecks in just a few minutes.

2. Reduces Errors

Payroll mistakes can lead to underpayments, overpayments, or legal issues. A reliable paycheck creator ensures accuracy by automatically applying tax rates and deductions.

3. Ensures Compliance

Payroll laws are complex, and staying up to date with tax regulations is crucial. A free payroll check maker helps ensure that your payroll process complies with federal and state tax laws.

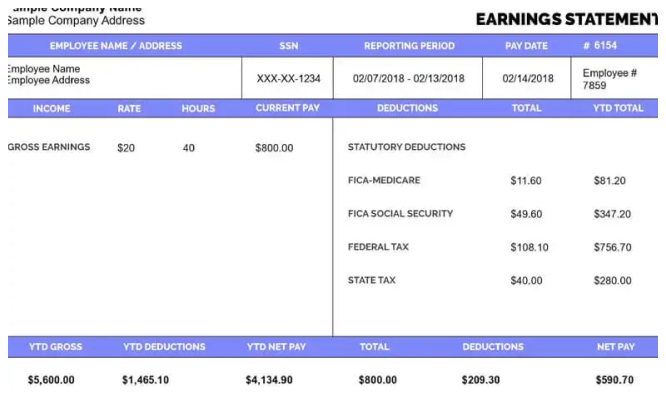

4. Generates Professional Paychecks

Instead of writing checks manually, a paycheck creator allows businesses to generate professional-looking paychecks. Many tools offer customizable templates that include company details and employee information.

5. Keeps Payroll Records Organized

Proper record-keeping is essential for tax filing and audits. Payroll check makers store digital copies of paychecks, making it easy to access past records when needed.

Who Can Benefit from a Free Payroll Check Maker?

A free paycheck creator is useful for various professionals and business owners. Here are some of the key audiences who can take advantage of these tools:

1. Small Business Owners

Managing payroll manually can be overwhelming for small business owners. A payroll check maker allows them to process payroll efficiently without hiring an accountant.

2. Freelancers and Independent Contractors

Freelancers often work with multiple clients and need to generate paychecks or invoices. A free payroll check maker helps them create professional payment records for their income.

3. Startups and Growing Businesses

New businesses may not have the budget to invest in expensive payroll software. A free tool allows them to manage payroll affordably while focusing on business growth.

4. Self-Employed Professionals

Self-employed individuals, such as consultants and gig workers, can use a payroll check maker to document their income and maintain accurate financial records.

5. Employers with Remote Workers

Companies with remote teams need an efficient way to manage payroll across different locations. A digital payroll check maker simplifies the process and ensures timely payments.

Features to Look for in a Free Payroll Check Maker

When choosing a free paycheck creator, look for the following features to ensure it meets your business needs:

1. Customization Options

A good payroll check maker allows you to customize paychecks with your company name, logo, and employee details.

2. Automatic Calculations

The tool should calculate gross pay, deductions, and net pay automatically to minimize errors.

3. Tax Compliance Support

Ensure that the payroll check maker follows tax regulations, including federal and state tax deductions.

4. Printable and Digital Paychecks

The ability to download, print, or email paychecks makes payroll processing more convenient.

5. Secure Storage and Record-Keeping

A reliable payroll tool should provide secure access to past payroll records for easy reference.

How to Use a Free Payroll Check Maker

Using a payroll check maker is simple and requires just a few steps:

Step 1: Enter Employee Information

Start by adding employee details, including name, job title, and payment frequency.

Step 2: Input Payment Details

Enter the number of hours worked, hourly rate, salary amount, or any additional earnings.

Step 3: Apply Deductions

Include any tax deductions, insurance contributions, or benefits applicable to the employee.

Step 4: Review and Generate

Double-check the information for accuracy and generate the paycheck.

Step 5: Print or Send

Download the paycheck as a PDF, print it, or send it via email to the employee.

Conclusion

Payroll doesn’t have to be complicated. A free payroll check maker provides a simple, cost-effective solution for businesses, freelancers, and self-employed professionals to manage payroll efficiently. By automating calculations, reducing errors, and ensuring compliance, these tools help save time and eliminate payroll headaches. Whether you’re a small business owner, a freelancer, or an employer managing a remote team, using a free paycheck creator can make payroll management effortless and stress-free.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons

Why Keeping Your Starbucks Pay Stub Is Important

Why Instacart Pay Stubs Matter for Your Financial Records?