In today’s fast-paced world, managing payroll for your business or handling your pay stubs has become easier with the rise of online tools. One such tool that many individuals and small business owners use is a check stubs maker. Whether you’re an employer looking to streamline your payroll process, or an employee needing a pay stub for a loan or rental application, an online check stub maker can save you a lot of time and effort.

But with so many options available, choosing the best check stub maker for your specific needs can be overwhelming. In this guide, we will walk you through what to look for in a check stub maker, key features to consider, and tips to ensure you choose the right tool for your business or personal use.

What is a Check Stub Maker?

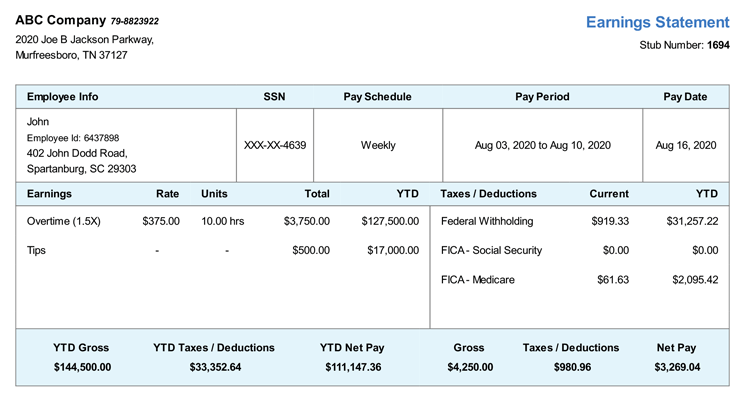

Before we dive into choosing the best check stub maker, it’s essential to understand what this tool is and why it’s so useful. A check stub maker is an online tool that allows you to create pay stubs for employees or yourself. Pay stubs are important for documenting employee earnings, tax deductions, and other financial details related to employment.

A check stub maker typically provides an easy-to-use platform where you can input details such as:

- Employee name

- Employer information

- Gross income

- Deductions (taxes, insurance, etc.)

- Net pay

After entering the relevant information, the tool generates a pay stub that you can download, print, or email. This can be particularly helpful for employers who need to produce pay stubs regularly and employees who may need to show proof of income.

Key Features to Look for in a Check Stub Maker

When choosing a check stub maker, there are several features you should keep in mind to ensure the tool meets your needs. Here’s a list of features to look for:

User-Friendly Interface

A check stub maker should have a simple and intuitive interface that makes it easy to generate pay stubs, even if you don’t have any technical expertise. Look for a platform that allows you to create check stubs in just a few steps, with clear instructions for entering details.

Customization Options

Every business is unique, and so are its payroll needs. Choose a check stub maker that allows you to customize the pay stub to reflect your company’s specific requirements. Look for the ability to add your company logo, adjust tax deductions, or create pay stubs for different types of employees (e.g., hourly, salaried, or contractors).

Accurate Calculations

Accuracy is key when it comes to payroll. Ensure that the check stub maker provides accurate calculations for gross pay, deductions, and net pay. Some tools even include built-in calculators for taxes, benefits, and other deductions, which can help avoid errors in payroll processing.

Compliance with Tax Laws

Tax compliance is a critical concern for businesses of all sizes. A good check stub maker should ensure that the calculations align with local, state, and federal tax laws. This is particularly important in the USA, where tax laws vary by state and can change frequently. Look for a tool that stays up to date with the latest tax rates and regulations.

Multiple Payment Frequency Options

Businesses often pay employees on different schedules: weekly, bi-weekly, or monthly. Choose a check stub maker that allows you to select from various payment frequency options to match your payroll cycle. This flexibility will make it easier to manage payroll for different types of employees.

Support for Different File Formats

Once your pay stub is generated, you’ll need to download and share it with employees or keep it for your records. A reliable check stub maker should allow you to download pay stubs in multiple file formats, such as PDF, Excel, or Word, making it easy to save or send them electronically.

Security and Privacy

When dealing with payroll, it’s crucial to ensure that employee information is kept secure. Look for a check stub maker that uses encryption and other security measures to protect sensitive data, such as Social Security numbers, bank account details, and other personal information.

Customer Support

If you run into issues or have questions about using the check stub maker, it’s helpful to have access to customer support. Choose a platform that offers reliable customer support through phone, email, or chat. This can be a lifesaver if you encounter problems while creating pay stubs or need assistance with tax calculations.

Benefits of Using a Check Stub Maker

Using an online check stub maker offers several advantages, including:

Time-Saving

Creating pay stubs manually can be time-consuming and error-prone. With an online check stub maker, you can quickly generate professional-looking pay stubs without spending hours on calculations or paperwork. This is particularly helpful for small business owners who handle payroll themselves.

Cost-Effective

Instead of hiring an accountant or payroll service to create pay stubs, you can use an online check stub maker for a fraction of the cost. Most tools offer affordable pricing plans, and some even provide free versions for basic use, making them an ideal choice for small businesses or individuals.

Accuracy and Compliance

By using a check stub maker, you can ensure that your pay stubs are accurate and comply with tax laws. These tools often include built-in calculators for tax deductions, benefits, and other withholdings, ensuring that everything is calculated correctly. This reduces the risk of errors that could lead to legal or financial complications.

Easy Record-Keeping

A check stub maker makes it easy to keep track of pay stubs for future reference. Whether you need to show proof of income for a loan application or maintain records for tax purposes, digital pay stubs are easy to store and retrieve when needed.

How to Choose the Right Check Stub Maker

Now that you understand the key features and benefits, here are a few tips on how to choose the best check stub maker for your needs:

Consider Your Budget

While there are free check stub makers available, some businesses or individuals may require more advanced features, such as tax calculations or customization options. Look at your budget and choose a check stub maker that offers the best value for your needs.

Look for Reviews and Recommendations

Before committing to a particular tool, check for online reviews and recommendations from other users. This can give you an idea of the tool’s reliability, ease of use, and customer support. Real-world feedback is often the best way to determine whether a check stub maker is right for you.

Test the Tool

Many check stub makers offer free trials or demos, allowing you to test the platform before committing to a paid plan. Take advantage of this to see if the tool meets your expectations and if it’s easy to navigate. Testing will also help you determine if the platform includes all the features you need.

Consider Additional Features

Some check stub makers offer additional features that could be useful for your business or personal use. For example, some tools provide the option to create invoices, track time worked, or even integrate with accounting software. If these features are important to you, be sure to choose a check stub maker that offers them.

Conclusion

A check stub maker is an invaluable tool for both businesses and individuals, helping you manage payroll, maintain accurate records, and stay compliant with tax laws. By considering the features mentioned above and doing some research, you can choose the best online check stub maker that suits your needs. Whether you’re a small business owner or an employee needing pay stubs for personal use, the right tool can make the entire process easier, faster, and more efficient.

Don’t forget to test a few options and read user reviews to find the tool that works best for you. With the right check stub maker, you can streamline your payroll process and ensure accuracy, all while saving time and money.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season